Widely considered the future of digital commerce, embedded finance is when a non-financial institution provides financial services. So, while the term itself may or may not be familiar to you, the chances are huge that you’ve already encountered some iteration of it, such as:

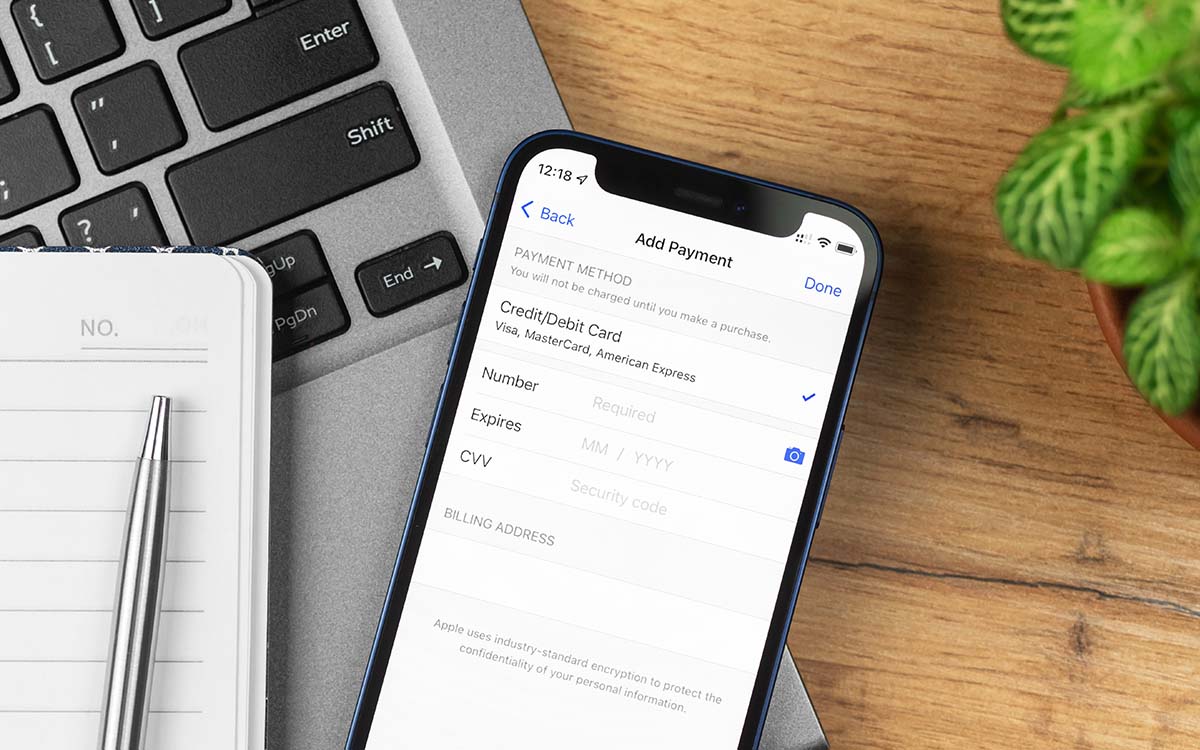

1-Click Payments

You’ve probably used these through your Starbucks card or app or ride-sharing services like Uber, Lyft, or Grab. You link these to your credit card or bank account, which enables you to pay for products and services with a single click. These 1-click payment options are also called ‘digital wallets,’ and 4.4 billion global consumers are expected to shop with a digital wallet by 2023.

Digital Installment Plans

Any establishment that offers you an automated buy-now-pay-later option spreading the payment out over months or even years – handles intricate financial arrangements on your behalf, again coordinating with your bank or other preferred financial organization. Payment installments enjoyed a US$1.6 trillion market value in 2020 and have only gone up by 5% year-on-year since then.

Combined Services

Combined services are when a flight booking operator offers you travel insurance or when you use Google Maps to find parking and then use Google Pay to pay for it. This brings customers convenience—they don’t have to fill out insurance forms, for instance, because they already did that for the flight booking—and added value. Instant payment is predicted to see 199 billion transactions by 2024.

So now we’ve covered how ubiquitous embedded finance is. Let’s talk about why it’s important:

- Mobile payments constitute 73% of the total e-commerce market, but

- mobile payments also have the highest abandonment rate, at 86%, with

- 6% of consumers leave their carts unpurchased due to inadequate payment options.

Meanwhile:

- 88% of companies that use embedded finance have seen increased engagement.

- 85% of companies that use embedded finance state that it’s helped them gain new customers.

With all that in mind, it’s looking like embedded finance is, in fact, the future of digital commerce – and certainly a key component toward the swift, simple, and seamless customer experience that today’s consumers demand. Innovative businesses must capitalize on embedded finance’s enormous potential to improve performance, profitability, customization, and conversion.